Mandatory Electronic Invoicing in United Arab Emirates

Learn how to get your company ready to exchange documents in accordance with regulations in UAE with the support of Comarch

Learn how to get your company ready to exchange documents in accordance with regulations in UAE with the support of Comarch

The United Arab Emirates introduced VAT only in 2018, following the example of the system in Europe. A natural consequence of this step is the planned digitization of taxpayers' settlements with public entities and, thus, the elimination of their documentation in paper form. This process is supported by a fully digital public procurement platform (DPP) that implements B2G contract processes.

When it comes to exchanging electronic invoices between entrepreneurs, it is possible, provided that both parties consent to it. Introducing mandatory e-invoicing for the B2B sector is a logical next step in this process. According to the plan announced by the Ministry of Finance of the United Arab Emirates on July 11, 2023, the commencement of the B2B e-invoicing obligation will come into force in July 2025.

A detailed model of the future e-invoicing system is yet to be announced. However, it is widely believed that this system will mirror the structure of a previously introduced system by the Kingdom of Saudi Arabia.

The mandate itself is expected to be introduced in two stages:

Although the issuance of electronic invoices is not mandatory in the UAE, it is already permitted to exchange e-invoices on a voluntary basis, but the planned digitization of settlements between taxpayers and public entities. The goal is to save time, eliminate the risk of errors and care for the environment by reducing the amount of paper invoices.

Through the Digital Procurement Platform, the UAE Government allows electronic/digital invoices to be sent in connection with their purchasing operations or to ministries and federal entities.

Invoices must be securely stored in such a way as to guarantee their integrity, authenticity and availability during the storage period.

Required storage period is 5 years after the end of the tax period to which the invoice relates.

To issue electronic invoices, taxpayers must guarantee the integrity and authenticity of the document. Electronic signatures are regulated but not mandated.

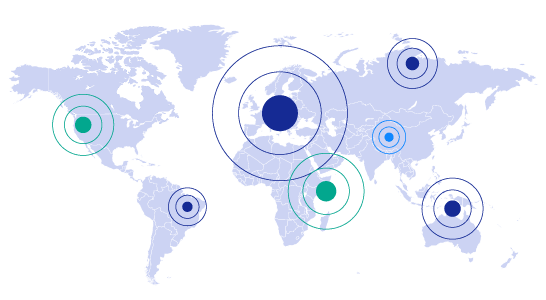

We have 20+ years of experience in carrying out various EDI, e-invoicing, and other document exchange projects around the world. In those years, we have successfully connected more than 130,000 entities from over 60 countries.

Full compliance with the latest data exchange regulations and modern data transfer standards

Applying new technologies and IT solutions in order to streamline workflows and automate activities and procedures

Tailor-made solutions based on processes specific to each company – own road map and a suitable pace of changes

Highest level of security for all sensitive and important company data

If your company is based or has branches in the CountryName and you need to prepare your billing and tax systems to comply with the new requirements. Click on the button below to get in touch with one of our experts.