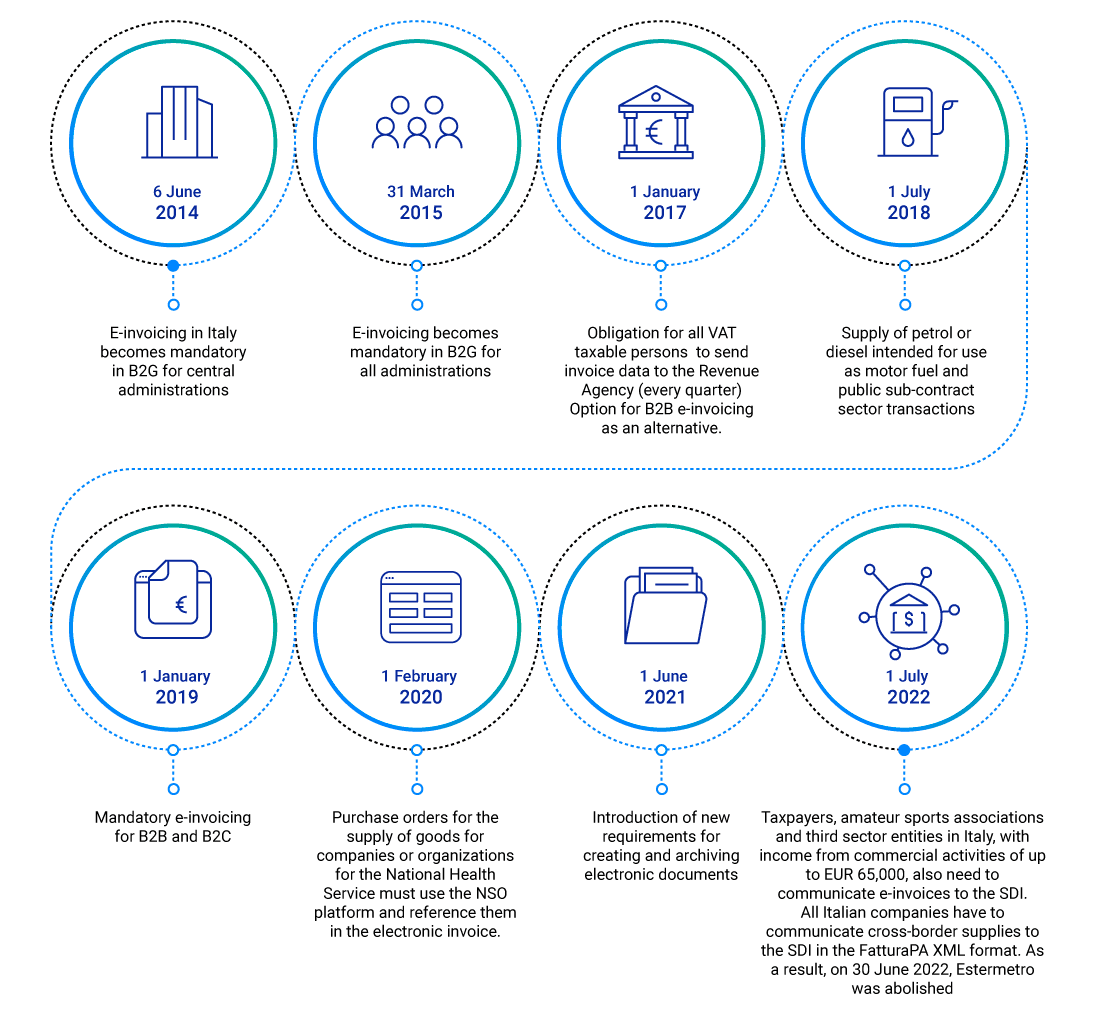

The Italian E-Invoicing Model

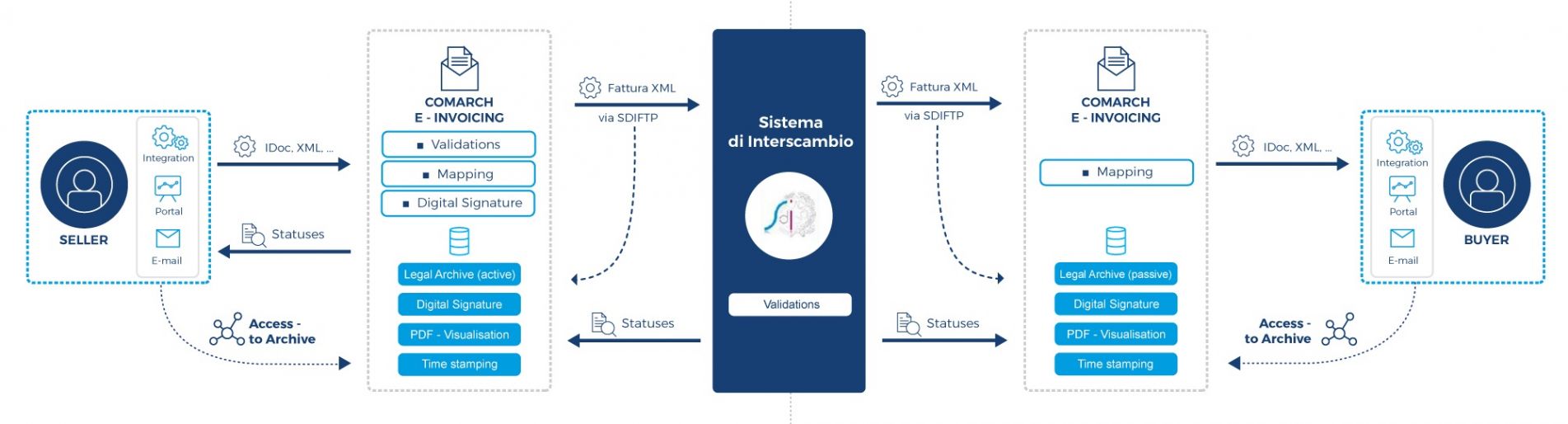

Everything You Need to Exchange Invoices

in Line with the Regulations

If you are doing business in Italy or want to enter this market,

you need to send invoices in a structured way.

Check what obligations you need to meet.